Introduction

Beyond numbers, the finance team identifies challenges, informs decisions, and shapes the company’s future. A strong finance department is similar to a strategic map, resulting in significant profits, unexpected growth, and increased operational efficiency.

The modern business landscape is evolving, with remote work transforming collaboration and the finance department playing a crucial role in a company’s success.

This article explores strategies to supercharge both your team’s remote work capabilities and the efficiency of your finance department. In addition, you will also discover the wonders of tapping into remote work in the Philippines.

Secret #1: Identify your Top Challenges

Before embracing remote work, it’s essential to identify the challenges your team may face.

The first step to boosting your finance department’s productivity is to recognize the productivity killers.

- Paper-based finance processes

To use paper is to lose time, make mistakes, and not be able to progress. Not only do analog methods waste time, but they also lead to mistakes that make it harder to scale.

- Manual data entry

While human data entry is becoming less common, its continued use endangers precision and timeliness. Digitizing supplier invoices, receipts, and tax-related correspondence is critical, but manually entering data increases inefficiencies and risks costly errors.

- Lack of automation

Automation, the driver of disruptive change, brings in a new era of efficiency. By embracing digital technologies, accountants may automate laborious procedures and reap immediate benefits. Complexity is reduced as important equations connect easily, allowing the financial staff to prepare reports with a few clicks.

- Lack of communication and collaboration

Communication between finance teams and other departments is crucial. The persistent segregation of financial processes—be it invoices, expenses, credit cards, or payroll—can breed knowledge imbalances and necessitate additional effort to connect the dots.

By acknowledging these challenges and addressing them, you can create a more effective and supportive remote work environment.

Secret #2: Find the Right Talent

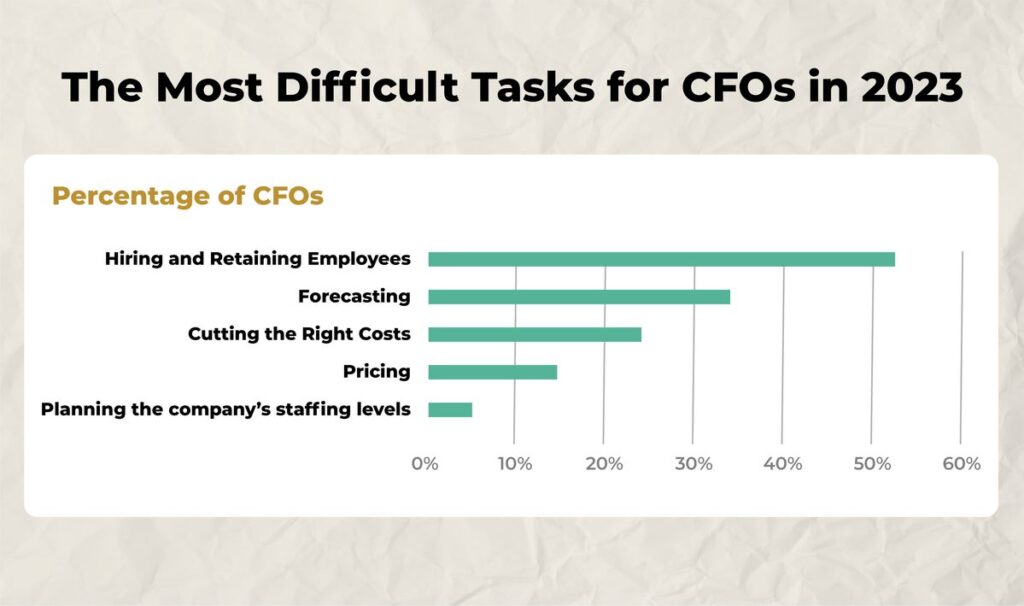

A 2022 survey found that the most challenging task confronting CFOs (Chief Financial Officer) is hiring and retaining people. A tight job market is one of the most important problems that businesses must deal with. It’s part of a triad that also includes the long-term problems of inflation and supply shortages.

Of course, increasing pay is one tactic to keep people on board, but it won’t fix the issue on its own. Modern employees want work-life balance and scheduling flexibility, not simply financial incentives.

Companies ought to evaluate their recruiting strategy to ensure they do everything possible to identify the best candidates to fill open positions.

Secret #3: Prioritize your Team’s Technology Literacy

Technology literacy is an investment in the future that has been revolutionizing finance departments.

This secret encourages financial software, data analytics, and AI expertise because technology is a catalyst for change. Digitally aware financial teams become efficient architects, improving operations and strategy.

Some digital transformation solutions for finance teams include:

- Accounts payable automation can help streamline operations and increase efficiency.

- Performance management software connects corporate planning, group consolidation, business intelligence, and analytics, allowing finance teams to make better decisions.

- AI tools can tackle the “busy work” while your staff concentrates on more severe issues.

By identifying your top challenges, securing the right talent, and prioritizing your team’s technology literacy, you’re not just enhancing efficiency – you’re charting a course for sustained success in the dynamic world of finance.

Tap into Remote Teams for Scaling and Hiring Talent (at a fraction of the cost)

Leveraging the flexibility of remote work not only expands your potential to attract top-notch talent but empowers your team to overcome challenges and thrive in the digital age.

This approach provides access to a global talent pool without incurring the high expenditures typically associated with traditional office space and employee benefits.

By hiring remote teams, you can save on expenses related to office rent, utilities, and employee perks.

While in-house hiring allows for greater operational control and easier team management, it can be costly and limit the number of job candidates.

Furthermore, in-house employment may not always deliver the breadth and depth of service required, and staff utilization issues can arise.

This approach can also be costly for small businesses, considering salaries, benefits, and overhead expenses.

Moreover, finding and retaining qualified professionals may pose a challenge, and the company may face limitations regarding expertise and scalability.

As a result, delegating certain finance tasks can assist small businesses overcome the constraints in knowledge and scalability that come with in-house hiring. Finally, remote staffing solutions can give small firms access to highly skilled financial specialists, resulting in cost savings, specialized experience, and enhanced flexibility.

Philippines, A Remote Work Hub

Due to its robust English proficiency, competitive salaries, and reliable internet connectivity, remote work in the Philippines has gained widespread popularity as a sought-after destination.

A key advantage is that legal documents, commercial contacts, and educational resources are primarily written in English. This linguistic harmony allows for seamless collaboration across all sectors, from government engagements to company operations, resulting in a smoother and more effective working environment.

By designating or offshoring specific tasks or entire projects to the Philippines, you can tap into a skilled workforce at a fraction of the cost.

Team Up with iSWerk

We knows how crucial it is for small businesses to manage their finances well.

That’s why we offer remote staffing solutions that connect you with skilled bookkeepers and accountants who can work with your business smoothly.

Our remote staff can take care of different financial tasks, such as accounts payable, accounts receivable, payroll management, financial reporting, and more.

What You Get with iSWerk

Cost Efficiency

iSWerk helps businesses save costs by offering remote staffing instead of in-house solutions, covering office, equipment, and benefits expenses.

Access to Specialized Talent

iSWerk connects companies with a wide range of skilled professionals who meet their specific needs.

Scalability

With remote staffing, companies can easily adapt to changing needs without the trouble of hiring and training new staff.

Tailored Solutions

iSWerk carefully chooses expert bookkeepers and accountants who have a deep knowledge of their industry’s financial details.

Seamless Integration

Our smooth onboarding process ensures the easy integration of remote staff into your financial system, setting up communication, goals, and workflows for optimal efficiency.

Cutting-Edge Technology

iSWerk uses the latest financial management technology, enabling our remote staff with tools that boost productivity and accuracy, from cloud-based accounting software to secure communication platforms.

Our team of experts can help you identify your challenges, find the right talent, and upgrade your team’s technology literacy, especially when you consider the thriving landscape of remote work in the Philippines.

Book a NO-OBLIGATION consultation today to discover how we can supercharge your team through remote work.